Via Maryland Chamber of Commerce

Where does Maryland rank for taxation on individuals, businesses and property?

As we continue our series of spotlights on where Maryland ranks compared to other states regarding key economic indicators, today we’re focusing in on where Maryland ranks currently for taxation on individuals, businesses and property.

Here’s a closer look at what the data reveals and why it matters to Maryland:

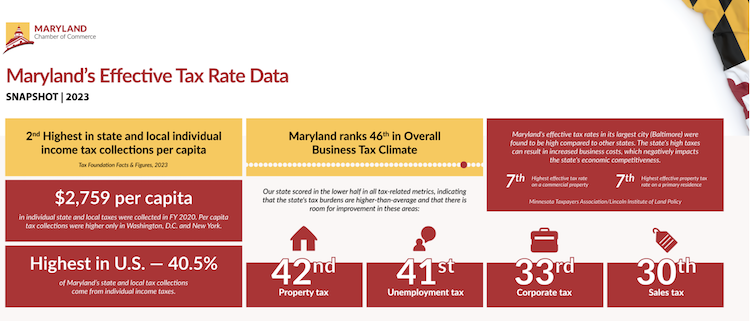

* Maryland ranks as having the 2nd highest amount of state and local individual income tax collections per capita. In Fiscal Year 2020, Maryland collected $2,759 in state and local individual income taxes per capita. The only areas ranking higher in this metric are Washington, D.C. and New York. 40.5% of Maryland’s State & Local Tax Collections come from Individual Income Taxes – this is the highest percentage in the country. (Tax Foundation Facts & Figures, 2023)

* According to the Tax Foundation’s 2023 Fact & Figures report, Maryland ranks 46th in Overall Business Tax Climate. Maryland scored in the lower half in all metrics including Corporate Tax (33rd), Ind. Income Tax (45th), Sales Tax (30th), Unemployment Ins. Tax (41st), and Property Tax (42nd)

* When comparing effective tax rates in each state’s largest city, Maryland ranked as having the 7th highest effective tax rate on a commercial property, and as having the 7th highest effective property tax rate on a primary residence. Maryland ranked 24th for the state’s effective tax rate on an industrial property. (Minnesota Taxpayers Association/Lincoln Institute of Land Policy)